Debt consolidation remains a top financial strategy for those struggling with multiple high-interest loans. Among the myriad options, home equity loans for debt consolidation stand out as both a promising and intensive avenue to consider.

This guide will carefully navigate through the various aspects of using your home’s built-up equity to manage and pay off existing debts more efficiently.

What Is A Home Equity Loan For Debt Consolidation?

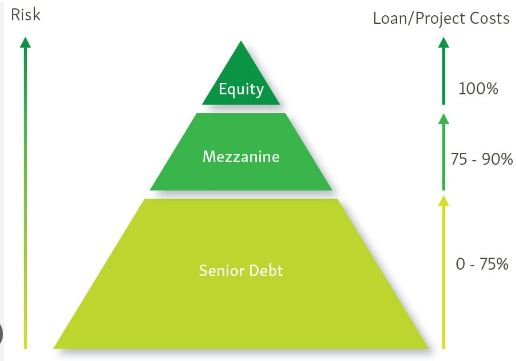

The concept of a home equity loan for debt consolidation hinges on utilising one’s home as a financial anchor. By tapping into the equity you’ve built in your home, you can secure a loan to repay numerous other debts.

Homeowners benefit from this strategy because not only does it condense assorted debts into one, but it also often comes with diminished interest rates due to the secured nature of the loan.

A closer look at the concept reveals several compelling reasons why this might be the right move for those in need of financial restructuring:

- Cost-effective interest rates: Secured by your home, these loans often boast lower rates than other unsecured lending types, such as credit cards.

- Streamlined finances: With only one monthly payment, managing your finances becomes less cumbersome.

- Potential interest savings: Over time, the cost difference between high and low interest rates can be staggering, and consolidating through a home equity loan can significantly trim overall interest outlay.

- Credit score improvement: Timely repayment can aid in boosting your credit score by lowering credit utilization and showcasing financial responsibility.

Nevertheless, don’t disregard the associated risks of such a pivotal financial decision:

- Possible loss of home: Defaulting on this type of loan jeopardizes your home since your property secures the loan.

- Assessment of financial capacity: Before opting for this debt consolidation route, evaluate your ability to meet the new loan requirements to prevent potential pitfalls.

How Does A Home Equity Loan For Debt Consolidation Work?

Home equity loans for debt consolidation are not obtuse financial products but are straightforward.

By liquefying your home’s equity, you gain access to funds that can extinguish various other debts, bringing them under one roof—one with potentially more favorable interest rates and a consistent payment schedule.

Here is a step-by-step breakdown of how this process operates:

- Equity assessment: The amount borrowed hinges on the equity available in your home.

- One-time payout: A lump sum is disbursed to pay off existing obligations like credit cards, medical bills, or student loans.

- Advantages of secure borrowing: Backed by your home’s value, this loan type often features lower interest rates, translating to substantial savings.

- Fixed repayment scheme: Borrowers enjoy the convenience of a consistent monthly bill with a precise end date in sight.

As always, the paramount risk is your home throughout this operation. Failure to fulfill your payment obligations paves the way for potential foreclosure, an outcome that must be factored into any decision-making process.

What Are The Benefits Of Using A Home Equity Loan To Consolidate Debt?

Taking a magnifying glass to home equity loans for debt consolidation, we observe an array of benefits that can alter the trajectory of one’s financial journey:

- Affordable borrowing costs due to lower interest rates compared with unsecured forms of credit.

- Simplify monthly payments, making budgeting a breezier affair.

- Tax incentives: Though subject to change, the interest might provide you with tax deductions, thereby sweetening the deal.

- Credit score upswing: Demonstrating control and consistency in your credit habits can bolster your credit score.

- Balancing large debts: Given the significant sums home equity loans can provide, substantial high-interest debts may be consolidated.

Example scenarios where these benefits would be palpable include:

- High-interest credit card debts becoming a controllable expense with lower rates.

- A chaotic array of monthly payments to various creditors is being replaced with one predictable amount.

- An improved tax return statement, pending eligibility for the interest deduction.

- An uptick in your credit score after consolidating debt and persistently making on-time payments.

- Eliminating a weighty personal loan or lofty medical expenses through the lump sum provided.

Eventually, you’ll want to confidently navigate through your monthly finances with a newfound ease brought by this consolidation strategy.

Are Any Risks Associated With Taking Out A Home Equity Loan For Debt Consolidation?

While the upside of home equity loans for debt consolidation glistens brightly, the potential hazards often lurk in the shadows, unheeded. These risks must be thoroughly vetted:

Debt snowball effect: An important note of caution here is that without disciplined financial management, you could find yourself amassing more debt on top of the consolidation loan.

Foreclosure is on the table: Damocles’s sword hangs over every homeowner who takes out a loan against their home.

The fine print: Interest rates that fluctuate and additional fees can erode the appeal of these loans.

A longer debt horizon: Extending your debt repayment period could increase your overall interest payout despite offering immediate relief through lower monthly payments.

Credit score fluctuations: Taking out new loans shifts your credit utilization, which might temporarily ding your credit score.

Consider these risks as the balancing weights on the scales when deciding whether to embark on this debt consolidation path.

How Do I Qualify For A Home Equity Loan To Consolidate My Debts?

Laying the groundwork for a home equity loan for debt consolidation requires a few preparatory steps. Before you dive in, take a beat to orient yourself:

- – Equity evaluation: The first calculation on your list should be a straightforward comparison of your home’s market value to your outstanding mortgage.

- – Lender’s prerequisites: Make sure you meet the credit score, income, and other criteria lenders will have in place.

- – Paperwork preparation: Essential documents will include tax returns, paycheck stubs, and mortgage statements, among others.

- – Financial introspection: Cast an honest gaze over your financial landscape and understand if you can responsibly manage this new loan.

- – Interest rate exploration: Draw comparisons across different lenders to find your best fit. Remember that not all loans are created equal.

These action items ensure you don’t go into the process blind but rather informed and ready.

Home Equity Loan

Discussing home equity loans in the context of debt consolidation can often feel abstract and intimidating, but these financial tools are tangible lifelines for strategic financial planning:

Capitalization on equity: These loans transform the theoretical value of your home into a practical, functional financial utility.

Interest and tax advantages: Beyond lowering your interest expense, you might also tap into tax breaks, making for a two-pronged financial benefit.

Predictability in repayment: With fixed terms and payments, the future becomes less of a murky financial fog and more of a calculable pathway.

Inherent risk awareness: Considering the foreclosure risk, it cannot be overstated. Before signing the dotted line, affirm your capacity to honour the new payment obligations.

Forearmed with this information, homeowners can make careful and considered decisions.

Home Equity Loan for Debt Consolidation with Bad Credit

Bad credit often feels like a financial anchor, sinking opportunities for relief under waves of high-interest rates and stringent borrowing conditions. Yet, home equity loans offer a beacon of hope:

– Secured nature: Your home’s equity serves as a life raft, potentially securing more favorable loan conditions even if your credit is less than stellar.

– Consolidation convenience: Channeling various debts into a single loan isn’t just practical; it can also help to repair a bad credit score over time if payments are consistent.

– Strategic planning: A comprehensive repayment strategy can mitigate the additional risk your bad credit introduces to the equation.

– Expert guidance: Consult with a financial advisor or credit counselor to chart the most advantageous course forward, ensuring this option aligns with your financial objectives.

You must paddle carefully through these waters, recognizing both the potential for smoother sailing and the possibility of rough tides ahead.

Home Equity Loan for Debt Consolidation Lenders

Identifying the right lender for your home equity loan for debt consolidation compares to finding the right guide for a treacherous journey:

– Interest rate environment: As these loans are more secure for the lender, they might offer more competitive rates, illuminating your consolidated debt favorably.

– Single creditor simplicity: Migrating all your debts to the umbrella of one lender reduces the administrative burden and clarifies your financial standing.

– Assessment of repayment capacity: Take stock of your income and outgoings before sealing the deal, ensuring a sustainable path to a debt-free future.

– Vendor vetting: A meticulous comparison of lender histories and customer satisfaction records will steer you toward a reliable and supportive financial partner.

Choosing the right lender offers better interest rates and a more transparent consolidation process.

Best Home Equity Loan for Debt Consolidation

When choosing the “best” home equity loan for your debt consolidation needs, a multifaceted approach is required:

- Rate Review: Low interest rates could be the wind in your sails, propelling you quicker towards your financial goals.

- Payment Predictability: Solidifying your financial forecast involves embracing loans with specific, stable repayment terms.

- Tax Perks: Consider the potential tax deductions in the hunt for the best.

- Terms Scrutiny: Beyond the allure of immediate financial relief, discern your loan agreement’s fine print and long-term implications.

Whether this deliberate deliberation places a crown on the head of a specific loan product, its value will be proven in your finances’ enduring health and stability.

Is It A Good Idea To Use Home Equity To Consolidate Debt?

To consolidate or not to consolidate using home equity—is a question that requires a balanced consideration of the entire financial chessboard:

– Cost Comparison: Calculating the delta between potential interest rates is critical—with lower rates, home equity loans often win the matchup.

– Simplified financial management: Reducing payment complexity might turn a troublesome financial web into a single, strong thread.

– Access to more significant loan amounts: The substantiality of home equity funds can be a game-changer for those dense, heavy debts.

– Mindfulness of default risks: Leveraging your home comes with the formidable risk of loss through foreclosure, so let caution be your guide.

– Tax perspective: Despite the potential tax benefits, navigate this terrain with professional advice to ensure accuracy.

A holistic view of your situation might illuminate whether using your home’s equity to consolidate is an intelligent financial strategy.

Home Equity Debt Consolidation Loan Calculator

Embarking on a journey through the realm of home equity debt consolidation calls for sharp navigational tools—and that’s where a loan calculator enters the stage:

- Borrowing gauge: A loan calculator removes the guesswork from your equity’s borrowing weight, integrating debt, equity, loan terms, and rates into a digestible monthly payment forecast.

- Cost scrutiny: You can pit home equity loans against other debt consolidation methods, allowing an apples-to-apples comparison.

- Scenario simulations: Modifying inputs can unfold various financial futures, allowing you to tailor your consolidation path before taking the plunge.

- Strategic summary: These calculators serve as strategic aids, illuminating the previously obscure depths of debt consolidation options.

Use this digital ally to chart a course through debt consolidation clearly and confidently.

Debt Consolidation and Home Improvement Loan

Combining the dual objectives of debt consolidation and home improvement through a home equity loan carries both promise and precaution:

- Dual-purpose funds: Utilize the strength of your home’s equity to prevent the tide of debt and enhance the vessel—your home—that secures it.

- Streamlined finance operations: Displace the mayhem of managing multiple debts with one focused home improvement loan, carving a clear path toward financial freedom.

- Tax boon revisited: The potential deduction of interest heightens the appeal of this consolidation route.

- Investment in asset value: Beyond debt relief, funneling funds into home improvement can amplify your property’s market worth.

- Calculated risk-taking: Weigh the advantages against the harsh reality of potential home loss, ensuring that your improvement plans don’t unintentionally undermine your financial foundation.

Before hoisting the sails on this strategy, ensure your home improvement aspirations align with your fiscal safety and stability.

Craft A New Financial Blueprint

Home equity loans for debt consolidation are potent yet intricate tools in the vast landscape of debt management strategies. They offer the allure of home-backed financial strength but come with significant risks that warrant prudent, measured contemplation.

These loans are not merely instruments of finance—they are potential keystones in your architecture of fiscal resilience.

As you prime to reshape your debt silhouette, reflect on the intertwining relationship between risk and return, cost and convenience, long-term repercussions, and short-term gains.

With this comprehensive guide, initiating your debt consolidation journey with a home equity loan can be a step toward financial clarity and control.

The key to unlocking these secrets lies in evaluating, strategizing, and proceeding with an informed and intentional fiscal plan.